Article contributed by Sylvia Mayer and Christopher Linden.

The United States in the decades before the crisis allowed a large amount of risk to build up in a variety of institutions outside the formal banking system. When the storm hit, that put enormous pressure on that system, causing a lot of tension and trauma across financial markets, amplifying the pressure on the formal banking system and adding to the broader damage caused by the economy as a whole.

Timothy Geithner, Treasury Secretary and FSOC Chairman, Oct. 2011

In recognition of the impact of nonbank financial institutions on the economic crisis in 2008 and 2009, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) extends the supervisory authority of the Board of Governors of the Federal Reserve System (the “FRB”), as well as application of the prudential standards of Title I of the Dodd-Frank Act, to nonbank systemically important financial institutions (“SIFIs”). In order to determine which companies are subject to these enhanced supervision and regulatory standards, section 113 of the Dodd-Frank Act tasks the Financial Stability Oversight Council (the “FSOC”) with establishing the parameters for identifying nonbank SIFIs. To this end, on October 11, 2011, FSOC issued its second Notice of Proposed Rulemaking (“Proposed Rule”), outlining the process by which nonbank financial companies will be subject to supervision by the FRB and the prudential standards included in the Dodd-Frank Act. Additionally, FSOC issued Proposed Interpretive Guidance (the “Proposed Guidance”), which provides a more in-depth description of how FSOC intends to apply the statutory standards and considerations outlined in the Proposed Rule. FSOC has submitted both documents for public comment. The comment period concludes on 60 days following publication of the Proposed Rule and Proposed Guidance in the Federal Register.

The following provides a summary of the significant provisions of the Proposed Rule. For a complete copy of the Proposed Rule and Proposed Guidance, go to [http://www.treasury.gov/initiatives/fsoc/Documents/Nonbank%20Designation%20NPR%20-%20Final%20with%20web%20disclaimer.pdf]. To review the relevant provisions of the Dodd-Frank Act, go to [http://financial-reform.weil.com/wp-content/uploads/2010/07/Dodd-Frank-Final-Text-Introduction-and-Title-I.pdf].

Overview

Essentially, the Proposed Rule establishes a three-step process by which FSOC will apply two “Determination Standards” (one based on actual or potential material financial distress and the other based on nature, scope, size, scale, concentration, interconnectedness or mix of activities) and a six-category analytic framework to determine whether a company should be deemed a nonbank SIFI. In an effort to increase transparency of the process, FSOC also issued Proposed Guidance, which provides additional details and insights into FSOC’s determination process.

Nonbank Financial Companies

Nonbank financial companies includes both U.S. and foreign companies (including branches located in the U.S.). Nonbank financial companies also encompasses virtually any type of corporate entity – corporation, L.L.C., partnership, business trust, association, etc. While FSOC is charged with establishing criteria to distinguish between nonbank SIFIs and other nonbank financial companies, the FRB is charged with defining what constitutes a financial activity. Pursuant to section 113 of the Dodd-Frank Act, only those nonbank institutions “predominantly engaged in financial activities” are subject to FSOC’s Determination Standards and increased supervisory powers. The FRB’s proposed rulemaking, which was published in February 2011 at 76 FR 7731, remains pending final approval.

Determination Standards and Statutory Considerations

According to the Proposed Rule, a particular nonbank financial company will be subject to heightened scrutiny if FSOC determines that (i) material financial distress at the nonbank financial company could pose a threat to the financial stability of the United States (the “First Determination Standard”) or (ii) the nature, scope, size, scale, concentration, interconnectedness, or mix of the activities of the nonbank financial company, could pose a threat to the financial stability of the United States (the “Second Determination Standard,” together with the First Determination Standard, the “Determination Standards”).

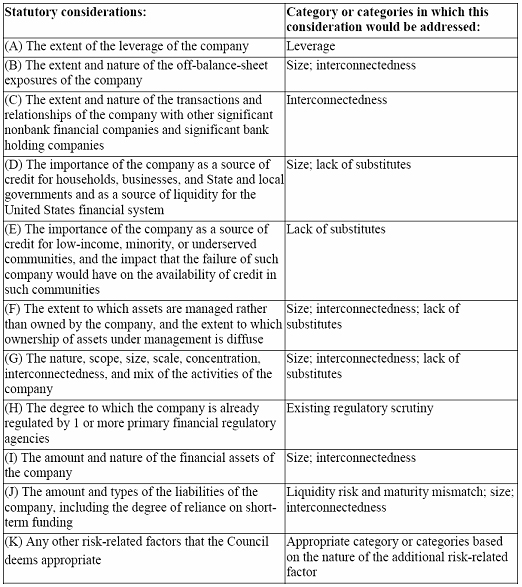

In deciding whether a particular nonbank financial company meets either of the Determination Standards, FSOC must consider the ten statutory considerations required by section 113 of the Dodd-Frank Act, which FSOC consolidated into a six-category analytical framework: size, interconnectedness, lack of substitutes, leverage, liquidity risk and maturity mismatch and existing regulatory scrutiny. The below chart explains which of the six categories each of the ten statutorily mandated considerations falls under.

Financial Stability Oversight Council, Proposed Interpretive Guidance, 12 CFR Part 1310 at p. 57 (Oct. 11, 2011).

Despite the in-depth description of the “considerations” that will be used in the Determination Process, FSOC stresses that the determination decision cannot be reduced to a formula and that each decision will be made on “a firm-specific basis, taking into account qualitative, as well as quantitative, information that the [FSOC] deems relevant to a particular nonbank financial company.”

The Determination Process

FSOC intends to follow a “three-stage process of increasingly in-depth evaluation and analysis,” culminating in a proposed determination (a “Proposed Determination”) that a certain nonbank financial company poses a threat to the financial stability of the United States. Throughout this evaluation process, FSOC will look to both qualitative and quantitative metrics.

Stage 1: Initial Identification of Nonbank Financial Companies for Evaluation

In Stage 1, FSOC will basically narrow the field of potential nonbank SIFIs by applying uniform quantitative thresholds, applicable across the financial sector. The entities identified in Stage 1 are those nonbank financial companies most likely to satisfy one of the Determination Standards outlined in the Proposed Rule. By employing objective quantitative thresholds, FSOC aims to provide clarity for nonbank financial companies that will most likely not fall within the purview of the Proposed Rule. In applying these initial quantitative thresholds, FSOC will look only to information/data available through “existing public and regulatory sources.” The quantitative thresholds employed at Stage 1 relate to the following analytical categories: size, interconnectedness, leverage, and liquidity risk and maturity mismatch.

A nonbank financial company will move to Stage 2 for further evaluation if it satisfies both the total consolidated assets threshold (which is $50 billion in global total consolidated assets for U.S. nonbank financial companies or $50 billion in U.S. total consolidated assets for foreign nonbank financial companies) and one or more of the other thresholds listed below:

- Credit Default Swaps Outstanding: $30 billion in gross notional credit default swaps outstanding for which the nonbank financial company is the reference entity, where gross notional value equals the sum of credit default swap contracts bought (or equivalently sold).

- Derivative Liabilities: $3.5 billion of derivative liabilities, where derivative liabilities equals the fair value of any derivatives contracts in a negative position after taking into account the effects of master netting agreements and cash collateral held with the same counterparty on a net basis.

- Loans and Bonds Outstanding: $20 billion of outstanding loans borrowed and bonds issued.

- Leverage Ratio: A minimum leverage ratio of total consolidated assets (excluding separate accounts) to total equity of 15 to 1. Separate accounts are excluded from the ratio calculation because such accounts are not available to satisfy claims of general creditors of the nonbank financial company.

- Short-Term Debt Ratio: Ratio of debt with a maturity of less than 12 months to total consolidated assets (excluding separate accounts) of 10 percent.

Additionally, because these uniform quantitative thresholds may not identify all of the means by which a nonbank financial company could pose a threat to financial stability of the United States, FSOC reserves the right to evaluate certain nonbank financial companies in this initial stage using other “firm-specific qualitative or quantitative factors, such as substitutability and existing regulatory scrutiny.” Companies identified during Stage 1 will be subjected to the Stage 2 evaluation (the “Stage 2 Pool”).

Stage 2: Review and Prioritization of Stage 2 Pool

At this stage of the process, FSOC will conduct a “robust analysis” of each nonbank financial company to determine the potential threat that each could pose to U.S. financial stability. As in Stage 1, FSOC will utilize publicly available information, including “information possessed by the company’s primary financial regulatory agency or home country supervisor, as appropriate, and information obtained from the company voluntarily.” Based on this information, FSOC will embark on a more focused evaluation of the “risk profile and characteristics of each individual nonbank financial company,” using the six-category analytical framework discussed above. FSOC will also evaluate the nonbank financial company using qualitative factors, such as whether the resolution of the specific nonbank financial company could pose a threat to U.S. financial stability, and the degree to which such nonbank financial company is already subject to regulatory scrutiny. After the completion of the Stage 2 analysis, FSOC will notify the nonbank financial companies identified as requiring further review (the “Stage 3 Pool”).

Stage 3: Review of Stage 3 Pool

It is at this point in the Determination Process that FSOC will formally notify the nonbank financial company that it is under consideration for a Proposed Determination (a “Notice of Consideration”). Contained in the Notice of Consideration will likely be a request that the nonbank financial company provide certain financial information relevant to FSOC’s analysis. FSOC will be seeking both qualitative and quantitative data, which may include “confidential business information,” such as

- internal assessments,

- internal risk management procedures,

- funding details,

- counterparty exposure or position data,

- strategic plans,

- resolvability,

- potential acquisitions or dispositions, and

- other anticipated changes to the nonbank financial company’s business or structure that could affect the threat to U.S. financial stability posed by the nonbank financial company.

Whenever possible, however, FSOC will rely on information available from the nonbank financial company’s primary financial regulatory agency. As part of its submission to FSOC, the nonbank financial company will be allowed to submit written materials to FSOC, contesting FSOC’s “consideration of the nonbank financial company for a proposed determination.”

At Stage 3 of the Determination Process, FSOC expects to have greater access to “information relating to factors that are not easily quantifiable or that may not directly cause a company to pose a threat to financial stability, but could mitigate or aggravate the potential of a nonbank financial company to pose” such a threat to the United States. These factors may include “the nonbank financial company’s resolvability, the opacity of its operations, its complexity, and the extent to which it is subject to existing regulatory scrutiny.” With respect to resolvability, FSOC will assess the complexity of the nonbank financial company’s “legal, funding and operational structure,” as well as any impediments to its “rapid and orderly resolution.” Additionally, FSOC will focus on legal entity and cross-border operations issues in evaluating resolvability, including

- the ability to separate functions and spin off services or business lines,

- the likelihood of preserving franchise value in a recovery or resolution scenario,

- maintaining continuity of critical services within the existing or in a new legal entity or structure,

- the degree of the nonbank financial company’s intra-group dependency for liquidity and funding,

- payment operation and risk management needs, and

- the size and nature of the nonbank financial company’s intra-group transactions.

Notification and Procedural Rights

After completing the Determination Process, FSOC will confer and vote on whether to make a Proposed Determination with respect to a certain nonbank financial company. If FSOC decides to issue a Proposed Determination, FSOC will issue a written notice to the respective nonbank financial company, outlining the basis of the Proposed Determination. At this point, the nonbank financial company will be permitted to request an evidentiary hearing before FSOC to contest the Proposed Determination. After such hearing, (if one is requested), FSOC will determine by a vote of two-thirds of the voting members of FSOC (including the affirmative vote of the Chairperson) whether to subject a particular nonbank financial company to supervision by the FRB and prudential standards (a “Final Determination”). Once again, FSOC will provide the affected nonbank financial company with written notice of the Final Determination, which will explain the rationale underlying FSOC’s decision. After such Final Determination is issued by FSOC, the affected nonbank financial company may seek judicial review by bringing an action in the United States district court seeking an order requiring the determination to be rescinded.

Anti-Evasion Provision

The Proposed Rule includes an “escape valve” provision, which authorizes FSOC to require that financial activities of a company that do not meet the statutory definition of a nonbank financial company be subject to FRB oversight and prudential standards, if FSOC determines that (i) “material financial distress related to, or the nature, scope, size, scale, concentration, interconnectedness, or mix of, the financial activities conducted directly or indirectly by a company . . . would pose a threat to the financial stability of the United States, based on consideration” of the ten statutory considerations described above, and (ii) “[t]he company is organized or operates in such a manner as to evade the application of Title I of the Dodd-Frank Act or” the Proposed Rule. This provision, as its name suggests, aims to prevent attempts to evade regulation through creative structuring. At the same time, however, this provision seems to run contrary to FSOC’s stated goal of providing clarity around which companies will be covered by the final rule.

Confidentiality

Addressing a concern raised by many companies, the Proposed Rule requires that any “data, information, and reports,” submitted in connection with the Determination Process, be maintained as confidential. In addition, the submission of any “non-publicly available data or information” in connection with the Determination Process will not constitute a waiver of any privilege arising under Federal or State law. These protections apply in both the emergency and non-emergency scenarios, as well as in the anti-evasion context. However, the Proposed Rule goes on to provide that any information submitted remains subject to the provisions of the Freedom of Information Act (“FOIA”), including any exceptions thereunder. Whether information will remain confidential remains to be seen as this process evolves and FOIA requests are submitted.

Anticipated Revisions to the Quantitative Thresholds

Concerned that the current quantitative thresholds used to identify problematic nonbank financial companies may not be the appropriate metrics across all financial sectors and firms, FSOC expects to review and possibly revise these thresholds as new information becomes available. FSOC points out three anticipated rulemakings, which will inform its thinking on this issue:

- credit exposure data proposed to be collected by the FDIC and FRB under section 165 of the Dodd-Frank Act;

- reporting and disclosure requirements being implemented under the Dodd-Frank Act; and

- proposed rules by the SEC and CFTC defining the terms “major swap participant” and “major security-based swap participant,” which contains a methodology for measuring the potential future exposure created by an entity’s outstanding derivatives

Emergency Exception

Notwithstanding the procedural requirements outlined above, FSOC may waive or modify any of the notice and procedural requirements with respect to a nonbank financial company if FSOC (i) “determines that such waiver or modification is necessary or appropriate to prevent or mitigate threats posed by the nonbank financial company to the financial stability of the United States; and (ii) [FSOC] provides written notice of the waiver or modification” no later than 24 hours after the waiver or modification is granted. If a waiver or modification of the procedural requirements of the Proposed Rule is granted with respect to a nonbank financial company, such company will be afforded the right to an evidentiary hearing contesting the waiver or modification.

Annual Reevaluation and Recission of Determinations

“Not less frequently than annually,” FSOC is required to reevaluate each currently effective determination and rescind any such determination if FSOC determines that the particular nonbank financial company no longer meets the requirements outlined in the Proposed Rule. Rescinding a determination requires the same two-thirds vote necessary to issue a Final Determination.

Conclusion

As with many of the other proposed rules implementing the Dodd-Frank Act, the devil is in the detail. While this second version of the Proposed Rule provides far greater detail, the process remains extremely complex.